Industry Gasification Through the Oil Collapse

Russian follies during Opec Plus’ meeting in Vienna on March 6, as well as oil roller-coaster on April 20, struck the whole world. The price of a barrel of benchmark US oil plunged below zero. There seemed to be nothing like this in principle. But it happened. Unlike the oil market, on the gas market everything looks pretty calm, although prices are also moving down dynamically. But this calm is very relative. Gas turbulences are still ahead… What will be the gas market after going through the current crisis?

GOLDEN AGE OF GAS

In 2010, the International Energy Agency, announcing a forecast for 2035, declared the onset of the "golden age of gas". The IEA’s then chief economist Fatih Birol said at the time that gas prices would fall due to excess supply, at least until 2020. As we can see, this prediction came true, unlike the prediction of Gazprom CEO Alexei Miller, who, as a mantra, repeated that the "era of cheap gas" was over. Although oil and gas prices have been going up in the early decades, the North American shale revolution has done its bit. Of course, the IEA could not have predicted the current pandemic and its consequences.

The global economic downturn caused by COVID-19 and the oil crash due to Russia's desire to destroy shale production in the US will have the effect of changing the mix of primary energy use. Global energy will no longer be what it was. The oil era, like the coal one, is not ending because of the lack of oil and coal. We just need other energy resources in the new round of technological development and in the context of overcoming environmental challenges and climate change. The 2015 Paris Climate Agreement and the European Union's 2019 large-scale Green Deal plan remain relevant. While health care issues will be a priority for national governments, it does not mean that environmental and climate issues will come to the fore.

At present, the "we can’t stand living like this" approach is triggered, that is, to burn fossil fuels and emit CO2, so we need to switch to RES immediately. This powerful impulse adds to the subconscious public feeling that a pandemic is a natural vengeance for humankind for a wild environment. On the other hand, the transition to the free sun and wind energy is still quite costly and beyond the means of poor people. The EU Green Deal has not yet been fully finalized by a number of member governments. Well, here cheap hydrocarbons - how not to use them in the transition to a bright and green energy future, but a little later. That is, we have a point of bifurcation, but at the same time, we should not hope that everything will change instantly.

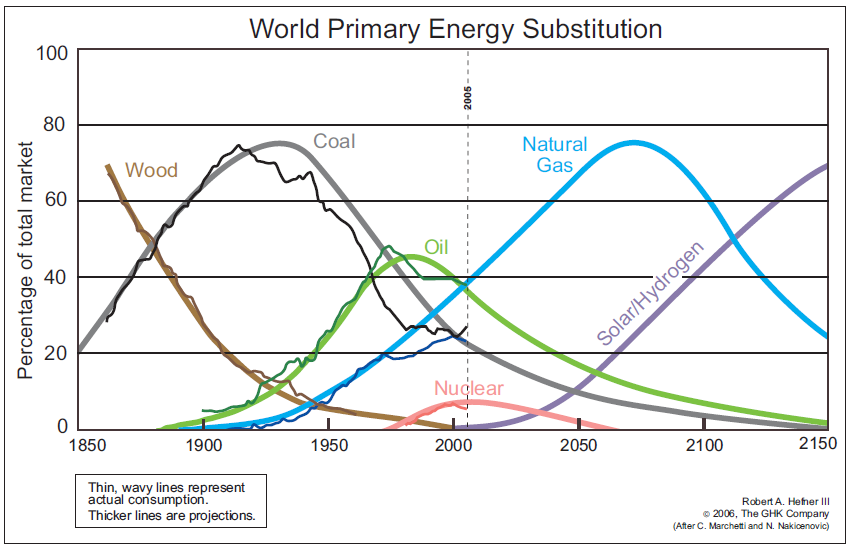

The attention of the energy industry before oil collapse has been largely focused on natural gas as the cleanest fossil fuel that produces the lowest CO2 emissions compared to using coal or petroleum products. In the diagram below (see Figure 1), Robert A. Hefner III in 2006, based on statistical processing, showed the growing dynamics of the increase in the share of natural gas in the global energy mix.

Figure 1. Hefner’s Wavy Lines

Therefore, natural gas has a great future for the coming decades, especially if, after all, commercially viable methane hydrogen production technology emerges. There is no of its shortage, as well as the oil shortage.

It is important that the liquefied natural gas (LNG) production and commerce emerged rapidly. And it is no coincidence. LNG has been present in the gas market since the 1960s. But its boom began in the passing decade. Largely due to the exploration of huge deposits of unconventional gas in North America and Australia. The future of gas will not be problematic, but its use, in our view, has prospects, in spite of all economic issues. It can be said that the emergence of LNG from Australia in the global market, while increasing its exports from the US, will have a significant long-term impact on global energy as a whole.

The great advantage of LNG is that, unlike pipeline gas, it can be delivered more widely, making it a global commodity, similar to oil or coal. This feature greatly limits the possibility of using gas as a means of manipulation, economic and political pressure, which was characteristic of Putin's policy in Europe, where Russia made gas supplies a weapon. In particular, this was characteristic of Gazprom's deliveries to the countries of Central and Eastern Europe. It is worth to mention the massive gas crises of 2006 and 2009, provoked by Moscow, have been directed not only against Ukraine but also against the EU as a whole. By the way, Russia's use of gas as a weapon has accelerated the development of the LNG market.

LNG’S GLOBAL POWER

The unprecedented and dramatic collapse of oil prices on March 9 and its continuation in April has a profound effect on all commodity markets, albeit to varying degrees. The situation is complicated by the limitation of economic activity in connection with the pandemic of the coronavirus, further fueling the fall in gas prices. LNG production in the world has been growing at a rapid pace until recently. In addition, Qatar, Australia and the US are becoming influential players in the global gas market. LNG, which was a kind of counterbalance to peak demand in isolated markets a decade ago, has become a factor of their integration, security of gas supply and the emergence of a global gas market. With LNG, the three largest gas markets - Asian, European and American - have evolved into three segments of the global gas market.

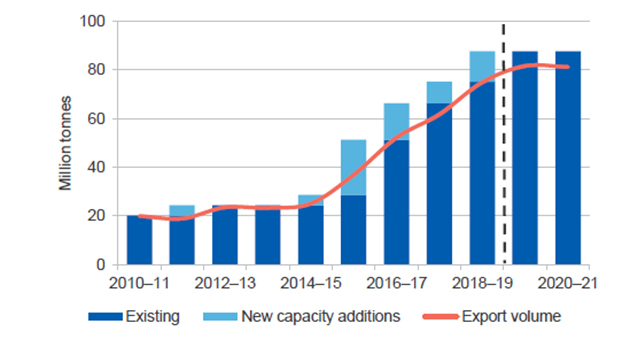

The construction of new LNG facilities in and around the world has been planned and is still in force for the 2020s. In the US, in 2018-21, capacity for the production of more than 81 million tons (106 billion cubic meters) of liquefied gas, is introduced. It was expected that by 2021 the development of production infrastructure would make the United States the third country in the world in terms of LNG exports following Australia and Qatar (see Figure 2). The situation is not so certain at the moment, however, it is unlikely that a price collapse will put a cross on these plans, rather, there will be some delay until the market situation changes. Certain projects will be frozen.

Figure 2. LNG export forecasts till 2021, million tonnes

In total, according to the US Department of Energy (see Figure 3), from 2016, when LNG exports began and through 2019, about 107.3 billion m3 of gas was exported. Moreover, almost 28 billion m³ (26%) has reached Europe. In 2019, exports amounted to 51.4 billion m3. The weighted average cost of these shipments was $ 4.99 per 1 million British thermal units, or about $ 175 per 1,000 m³.

Figure 3. US LNG export in 2016-2019 (bcf, share by regions)

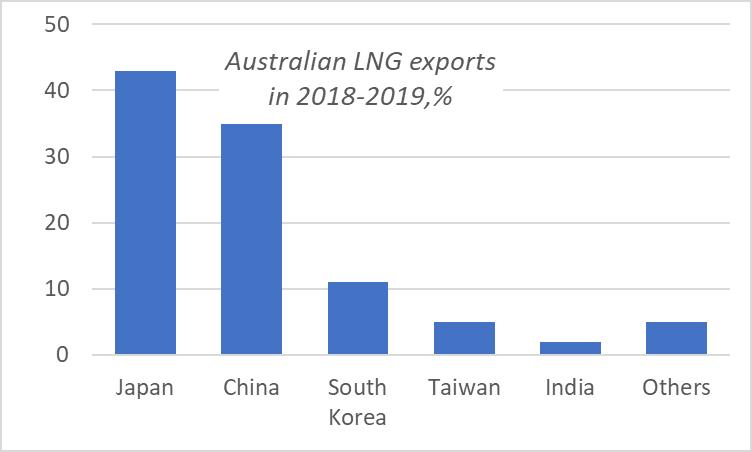

It seems that Australian gas is very far from European gas networks. However, Australian LNG is already affecting the EU gas market. Australia becomes the world leader in LNG exports. The implementation of two more LNG projects - Prelude and Ichthys - have increased LNG exports in 2019 to a record 78 million tonnes and in 2020, according to the Australian Government, up to 81 million tonnes (see Fig. 4). The main destination for Australian exports remains Asia - Japan (43%), China (35%) and South Korea.

Figure 4. Australian LNG export destinations in 2018-2019, %

However, the strong impact of LNG from Australia on the global gas market is evident when looking at the rapid growth in its exports over the last 5 years (see Figure 5).

Figure 5. Australian LNG export volumes in 2010-2019/2020 (forecasts)

Meanwhile, Russia is trying not only to continue construction of geopolitically motivated and economically unjustified gas pipeline projects across the Baltic and Black Sea, but also to initiate new ones - the Force of Siberia-2. And even the collapse of the oil market has not yet led to the complete shutdown of Putin's Nord Stream-2 pipeline project and the second strand of the TurkStream, although with the oil crash, the coronavirus pandemic and its market problems, the chances of their accelerated completion are more than ghostly.

The Russian Federation aims to increase the EU's dependence on Russian gas and maintain its monopoly on Russian supplies to the European market from the east. Russia has also launched a large-scale campaign to counter US liquefied natural gas in Europe. Instead, it offers Europeans its LNG produced at the gas fields of the polar Yamal, where its industrial activities are accompanied by both serious risks to the fragile Arctic nature and additional uncontrolled methane emissions from the permafrost layers. The economy of LNG production in the Arctic and its exports to Europe and Asia is lame because of its high cost. Its profitability is provided by tax benefits, unlike competing projects in the US, Australia or Qatar.

Interestingly, at a time when the European Commission is trying to prevent an increase in EU dependence on Russian gas, Russia has significantly increased its LNG supplies to the member states. In 2018, according to MacKinsey, Russian pipeline gas imports alone accounted for over 39%. Also, during the first half of 2019, part of the Yamal LNG to be exported to Asian markets was unloaded at European terminals. The idea behind Russia is, in principle, clear: to take the EU into ‘gas pincers’ by the Nord Stream and TurkStream pipelines, make it dependent on its supplies, including LNG, and at the same time counteract the construction of rival pipeline and LNG projects that bring non-Russian gas to the EU market. Of course, one can say that in the face of surplus and low prices, energy resources cease to be a weapon. But it is obvious that the Kremlin continues to live by inertia of the idea of Russia as an energy superpower.

LNG PROGRAMS UPDATES

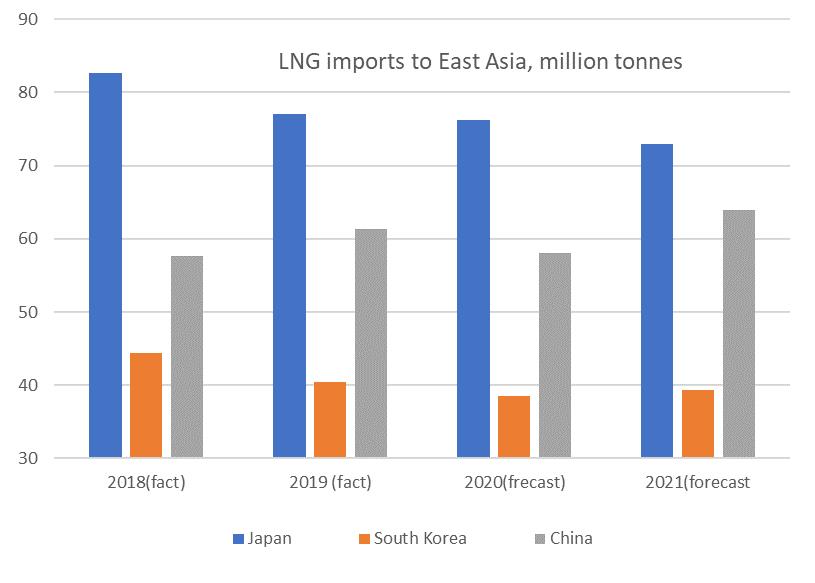

While coronavirus is spreading around the world, most countries are introducing restrictive measures that worsen demand for energy products. LNG market has its particularities , but is no exception, and LNG demand is also slamming. Just look at the East Asian Region, where countries currently import the lion's share of the world's LNG output.

In 2019, total LNG imports by the three leading Asian consumers - China, Japan and South Korea - amounted to 179 million tonnes (or 240 billion cubic meters). This is 51% of the 354 million tonnes (478 billion cubic meters) imported worldwide. ICIS Heren estimates that in 2020, LNG imports to China will fall to 58.1 million tonnes (5.2%), to Japan - to 76.2 million tonnes (-1.1%), to South Korea - to 38, 5 million tonnes (- 4.7%). (see Fig. 6).

Figure 6. LNG import volumes to East Asia, million tonnes

Thus, an excess supply is created and pressure is exerted on key price markers of both pipeline gas and LNG. Most long-term LNG shipments (60% of imports to China) are priced, depending on previous months' oil quotes.

Australian exporters, which account for almost half of China's total LNG imports, said the viral pandemic had limited impact on their operations, given that they were under-represented in the spot markets. A similar statement was made by Russian Novatek, which also supplies China with oil-indexed LNG. At the same time, oil indexation creates a discrepancy between the expected prices at the initial stage of signing contracts and the market pricing for LNG at the time when deliveries begin. The gap between spot and oil-dependent prices has now widened due to growing LNG supply from the US, weakening demand, particularly in China, which has led to lower spot prices, destabilizing the LNG market.

Therefore, these factors together will adversely affect long-term LNG production and regasification projects worldwide. The response of leading energy companies to the fall in world oil prices has not slowed down as a result of oversupply and falling demand from the coronavirus pandemic. In particular, their investment programs are shrinking.

But despite the unfavorable current situation, Qatar is not going to shorten its gas production and development program. According to Rystad Energy, Qatar will increase its LNG production capacity from its current 77 million tonnes to 126 million tonnes in 2023. Qatar is most likely to want to repeat the success of Saudi Arabia in squeezing Russia from the oil market, only in the case with the gas market.

EUROPEAN TRANSFORMATIONS

In 2014, the European Commission, in an effort to enhance energy security after the gas crises caused by Russia in the last decade, developed a new Energy Security Strategy (SWD 2014 330 final), as well as a special strategy for liquefied natural gas and gas storage. It is noted that by 2030 overall gas consumption in the EU is likely to decline, although this raises doubts over radical decisions by the largest EU economy, Germany, to shut down coal and nuclear generation. Due to the fall in gas production, there will be a continuing trend of increasing dependence on imports, which in the baseline scenario will be 73-79% of total gas consumption in the EU in 2030. The adoption of the ambitious European Green Deal in December 2019 may make some adjustments to gas consumption projections, as gas is the most environmentally friendly of all fossil fuels.

In order to minimize the potential negative effects on the EU of rising pipeline gas imports, LNG has been regarded as the main source of diversification of gas supplies in Brussels, specifically highlighting new sources and opportunities for its imports from the US, Qatar and East Africa. The strategy does not envisage the import of Russian liquefied natural gas. On the contrary, in order to reduce dependence on the Russian Federation, it was planned to implement a number of infrastructure projects, including construction and reconstruction of LNG terminals or placement of floating mobile terminals for storage and regasification in Poland, Baltic countries, Greece, Croatia. The LNG terminal in Poland and the FSRU in Lithuania are already in operation.

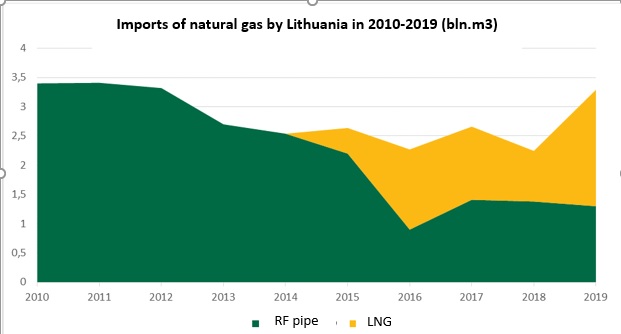

Figure 7. Natural gas imports to Lithuania: LNG displacing Russian pipeline gas supplies. 2010-2019. Source: Eurasia.expert

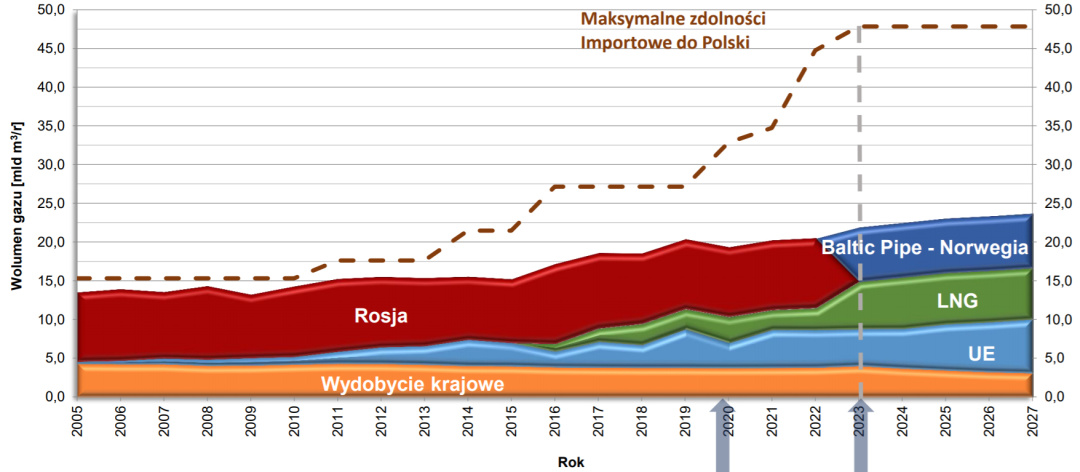

Figure 8. Dynamics of changes in the ratio of imports of pipeline and liquefied gas to Poland, 2005-2027. Source: Biznesalert.pl

At Fig. 7 and 8, we show clearly the examples of Lithuania and Poland where the structure of gas imports changes - more LNG, less pipeline imports from Russia.

When the capacity of European LNG terminals is compared to the pipeline import capabilities, an important example is Germany. This country is the largest EU importer of gas, including Russian gas. Since the 2000s, this factor, together with a particularly trusting relationship with Gazprom, has made a significant impact on the foreign policy of the German chancellors. Germany, unlike France, still has no direct access to the global LNG market. However, now the need to build LNG terminals has been admitted even in Germany. It is enough to look at the coalition agreement of the German Government of 18 February 2018, which contains a special section on the need to expand LNG infrastructure in Germany. It is clear that the pro-Russian lobby in Germany continues to attempt to torpedo LNG imports from the US, pushing to complete the Nord Stream 2 at any cost. These attempts are intensified after the end of the Merkel era and the transformation of the German political landscape after the elections.

Generally, in 2013-2018, 5 terminals were built (or increased in capacity) in 2013 by a total of 26.5 billion cubic meters, in particular in Italy, Lithuania, France, Poland, Malta and Greece. In 2021, the Croatian LNG project on the Krk Island (2.6 billion cubic meters) is completed. Spain will complete the Tenerife terminal (1.3 billion cubic meters) in 2021, and the Gran Canaria (1.3 billion cubic meters) in 2022. In April 2019, a decision was made to expand the Polish LNG terminal in Swinoujscie. Germany announces projects of Brunsbüttel terminal with capacity of 8 billion cubic meters and Terminal Wilhelmshaven, which offers 10 billion cubic meters.

The increase in interest in Europe for LNG imports has been driven by lower prices due to increased production, reorientation of LNG flows from Asia, falling oil prices and other factors.

About 75% of gas in the European Union is consumed in a competitive liquid market. The implementation of a strategy to enhance interoperability and network connectivity allows to flexibly redirect gas to demand-seeking or supply-depressed regions. The International Energy Agency predicts that targeted implementation of interconnector construction projects and full implementation of European directives on the internal gas market can help to eliminate bottlenecks. This will complete the creation of a fully integrated internal gas market, while diversifying sources of supply and improving energy security.

It is important that Ukraine, which has an Association Agreement with the EU, implements European gas legislation (enters the same legal field with the EU) and becomes a full-fledged part of the EU's integrated gas market. Gaining access to the LNG market, an alternative to Russian-dominated pipeline gas, is particularly important for Ukraine's national security. Some positive progress can already be noted here. In November 2019, the LNG pilot batch of 90 million cubic meters for Ukraine arrived from the USA at the Polish LNG terminal in regasified form and further was included into the GTS of Ukraine. So the beginning starts. The signing at the end of 2019 of new interconnection agreements between the GTS operator of Ukraine and Gazprom, as well as the neighboring European operators, allows to use the large gas transportation capacities previously blocked by the Russian monopoly and to conduct gas swap operations. Underground gas storage facilities in Ukraine are a good fit for the new configuration of the gas market in the east of the EU, which is formed not only by pipeline supply but also by LNG.

The development of a single European gas market opens up prospective opportunities for access to the world LNG market and its regasification from LNG terminals in Poland, Lithuania, Greece, Turkey, and Croatia.

Projects for the construction / reconstruction of LNG reception capacities in the EU have been awarded the status of Projects of Common Interest (PCI). Consequently, they are eligible for funding from the EU's 30 billion euro fund, which was created to enhance energy, transport and digital infrastructure. In 2020, CEF provides € 979.6 million to finance projects of common interest aimed at improving security of supply, eliminating isolated markets, interconnecting gas networks, achieving the goals of the European Green Deal.

The terminal built in Croatia (Krk Island) is one of the most important. According to the LNG Croatia project’s operator, over 60% of all construction works have been completed. Currently, the Golar Viking LNG tanker is being transformed by a Finnish Wärtsilä project into a floating storage regasification unit (FSRU). This ship is due to arrive in Krk in October. After commissioning from January 1, 2021, the FSRU will start to receive LNG and supply gas to the GTS after regasification. And these are additional opportunities for Ukraine. So, the coronavirus has not yet affected construction.

In turn, establishing relations with the Russian gas monopolist on the basis of European gas legislation contributes to greater integration of the European market, facilitating free gas flows, reducing the market distortions that Gazprom created, in particular in five EU Member States (Bulgaria, Estonia, Latvia, Lithuania and Poland) and Ukraine, and ultimately contributes to the security of gas supplies in Central and Eastern Europe.

To summarize, it should be noted that the global hydrocarbon collapse can lead to changes in the implementation of LNG infrastructure projects. But how important they will prove to be will become clear in the future as:

- coronavirus pandemic has a huge impact on both the European and world economies;

- the implications, including the feasibility of introducing planned new LNG facilities, will be specified;

- LNG imports to East Asia are projected to widen the price gap between long-term contract prices and the spot market;

- there is a tendency to reduce capital investments by the leading players in the global LNG market;

- measures taken in the EU to prevent COVID-19 increase the risks for the European economy and, as a consequence, for the implementation of infrastructure gas projects.

In order to quickly сope with the effects of a coronavirus outbreak, a € 37 billion investment initiative has been launched in the EU to support vulnerable parts of the economy. Which implies changes in funding from European Structural and Investment Funds. The Commission's winter economic forecast, published on 13 February 2020, has already identified coronavirus as a risk to the European economy.

SAVE THE ARCTIC!

Australian gas has already created a domino effect in the global gas market. Its entry to the Asian market - in China, Japan, South Korea - not only reduced gas prices in the Asia-Pacific region, but also forced Qatar and the US to pay more attention to the European market dominated by Gazprom, providing with other Russian state-owned company Rosneft the lion's share of Russia's budget revenues. Oil and gas revenues are one of the main sources of financial support for the Kremlin's aggression against Ukraine, its intervention in Syria, interference in the internal affairs of Venezuela, Libya, the Central African Republic, and subversive activity against the European Union and the US from inside, using a variety of proxies.

In December 2019, Russia loudly opened "Power of Siberia" pipeline, designed to export gas to China from the East Siberian gas condensate fields. But these fields have not yet been brought to project capacity. All the necessary infrastructure for their development will be built not earlier than 2025, and even so, provided that Gazprom is able to do it in the conditions of collapse of its revenues. For the first quarter of 2020, there is a double drop in its revenues. Gas collapse will be followed by oil, it is still ahead. And Gazprom's Enron-like bankruptcy, caused by concealing losses and pumping out financial resources from the company, on the backdrop of delay of the Putin's "streams" in the Black and Baltic Sea and the "forces" of Siberia, is a process that is accelerating. Obviously, the adverse for Gazprom environment in the European market will remain as prices will be volatile. So, the next 5-6 years will open a window of opportunity for US, Australian and Qatar gas expansion. According to Reuters, LNG deliveries are less vulnerable. As the analysts at one of Australia's leading energy consulting company EnergyQuest mentioned, the coronavirus is adding to the LNG market, but Australian exports are still steady.

The more non-Russian liquefied natural gas on the world market, the lower the prices, the lower the incomes of the Russian aggressive regime, in the conscience of which the lives of 13,000 Ukrainians killed in the East by Russian interventionists and their proxies, tens of thousands of Syrian citizens killed during the brutal bombing of Syrian cities, death of 298 citizens of different countries at MH17 flight, destroyed by rocket attack of the Russian anti-aircraft missile complex in 2014, use of nerve agent in Salisbury.

Therefore, when there is a surplus of supply in the global oil and gas markets, there is an opportunity to take advantage of buying more hydrocarbons from non-Russian sources and Russian gas and oil from non-Arctic sources. Predatory development by Putin's kleptocracy of Arctic fields not only violates the fragile nature of the Arctic but also threatens uncontrolled mass emissions, triggering a global methane catastrophe scenario.

It would be advisable for the European Union, Canada and the US to abandon exploration of Arctic oil and gas fields as there is no shortage of hydrocarbons. Significantly, the Norwegian Supreme Court is beginning to consider a lawsuit against hydrocarbon exploration in the Arctic, which was initiated by Greenpeace and other environmental organizations against the state-owned company Equinor. This lawsuit could set a precedent that would entail similar actions against companies from other countries seeking to engage in oil and gas production in the Arctic. First of all, this concerns Russia's Rosneft, Gazpromneft and Gazprom.

The states-violators should be subject to sanctions - their oil and gas must be subject to restrictions, or import duties should be imposed. Such a ban is fully justified against the background of the lack of gas shortages and the availability of alternatives in the form of Turkmen, Qatar, Australian, American gas, both pipeline and liquefied. It is through the use of natural gas and, in particular, in the liquefied form, that the path to greening the energy industry lies in the transition period.

Mykhailo Gonchar, Igor Stukalenko

CGS Strategy XXI